Authors: Satu Salminen, Jaakko Siltaloppi / Aalto University

The transition from fossil-based to bio- and circular economy is emerging as one of the major necessary societal transitions of the coming decades. While bio-based and recycled plastics are increasingly perceived as opening future business opportunities, as we have identified in the ValueBioMat project, in practice only a few companies have made significant business investment into renewable plastic materials so far.

To speed up the transition, the material producers (oil and petrochemical companies) play a pivotal role. As large multi-national corporations, the oil and petrochemical companies have an interest in protecting their market position and assets in refining and processing fossil raw materials. At the same time, these actors command the resources with which sustainable material innovations can be brought to the market in large volumes.

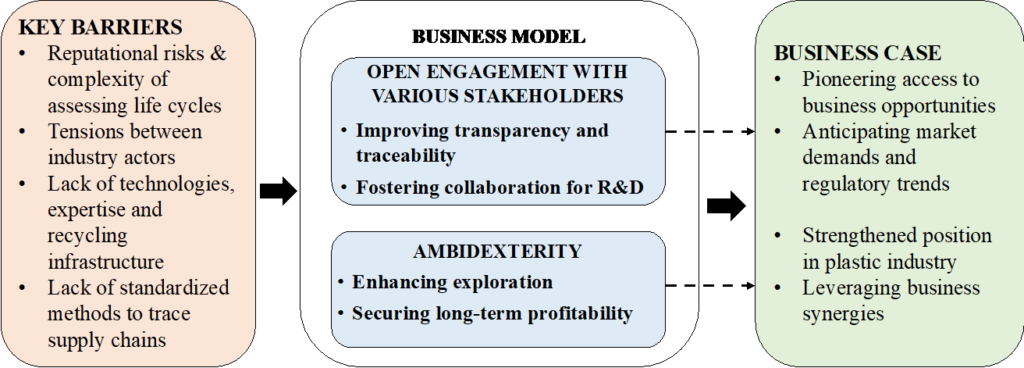

In our recent case study, we investigated the role of the business model in bringing renewable plastic materials to the market. Our findings identify two necessary changes to the business model of the raw material producers in order to address the key barriers of renewable plastics, and build a stronger business case for introducing them to the market in wider scale (see Figure 1).

Figure 1. Building a business case for renewable plastics through sustainable business model

First, there is a need for companies to open up their protective business approach to accommodate open engagement with various stakeholders. Given the increasing complexity of supply chains with renewable raw materials, new supplier relationships and collaborative processes are needed. In particular, open engagement and collaboration with both new and existing stakeholders can improve the effectiveness of R&D with new materials, and increase transparency regarding the provenance of the materials all the way down to the consumer. For example, collaboration with manufacturers is important to match the properties of new plastics to the desired uses and product designs.

Second, sustainable materials also call for companies to build ambidexterity in their business model. Business model ambidexterity refers to the ability of raw material producers to operate fossil-based and renewable product lines in parallel despite their distinct technological and business demands. For example, the production of renewable raw materials requires different supply chains, refineries and types of contact with customers, as well as differ from fossil-based operations in terms of the cost structure and market prices.

Importantly, business model ambidexterity allows companies to strengthen their strategic position as forerunners, as well as leverage the synergies between the business models for additional competitive advantage. In practice, this calls for companies to set up the renewable material operations and business units to support their exploration and innovation activities while exploiting the existing fossil-based operations. Furthermore, optimizing production capacity between fossil-based and renewable product lines to maximize overall business performance is something these companies can benefit from, particularly in the early stages of the transition to renewable business when the majority of turnover is generated from fossil products.

Overall, replacing fossil raw materials with renewables can offer the incumbent firms of the oil and petrochemical sector an attractive strategy for staying current in the society-wide transition to renewable energy. This transition, however, calls for these companies to diversify their business models and pursue innovation in collaboration with supply chain partners. When appropriately balanced within an ambidextrous business model, the oil and petrochemical companies can not only explore new technological directions more efficiently than innovative startups, but also exploit the emerging solutions more effectively due to internal synergies and significant resources necessary for operating in a very capital-intensive business area.

———————————————————-